Solving IFRS 17 Data Challenges: A Deep Dive for Insurance IT Leaders

Introduction

The new IFRS 17 accounting standard has upended insurance financial reporting, bringing unprecedented data challenges and opportunities. Effective from 2023, IFRS 17 requires insurers to capture and report far more granular data across actuarial, finance, claims, and legacy systems. Many insurers underestimated the effort – implementing IFRS 17 often meant heavy investments in data integration and IT systems to meet tight deadlines. This isn’t just a finance exercise; it’s an enterprise-wide data transformation. Insurance CIOs, CTOs, CDOs and other technology leaders must tackle massive data volumes, siloed legacy platforms, and rigorous compliance demands – all while accelerating insight delivery and controlling costs.

The Real-World Data Challenges of IFRS 17

IFRS 17’s complexity has surfaced several real-world data challenges for insurers. Understanding these pain points is the first step toward crafting a solution:

- Integrating Siloed Legacy Systems: Insurers often run multiple policy admin, claims, actuarial (e.g. Prophet), and finance systems that were never designed to work together. IFRS 17 mandates consistent, consolidated reporting, so ensuring data accuracy and integration from multiple sources is a significant challenge. Different systems output data in various formats (Excel files, text extracts, database tables), making end-to-end integration a tedious task. As one industry leader put it, “the biggest challenge has been putting the various systems together and making sure the data flows appropriately through [the architecture]”. Without an integration strategy, firms face manual data wrangling and reconciliation headaches.

- High Data Volume and Granularity: IFRS 17 dramatically increases the volume and granularity of data to be managed. Firms must handle detailed cash-flow and contract-level data for millions of policies – far more than under previous IFRS 4. Larger volumes of data at greater granularity drive tremendous complexity in data architecture2. Many insurers resorted to thousands of spreadsheets and ad-hoc databases to bridge gaps, which is neither scalable nor sustainable. KPMG observes that sourcing, integrating, and cleansing high-quality data is still an unresolved hurdle for many insurers. The data intensity of IFRS 17 also strains infrastructure for storage and processing, especially during peak reporting cycles.

- Data Quality and Compliance Pressure: Regulatory compliance under IFRS 17 leaves zero tolerance for errors. Financial results must be transparent, auditable, and trusted by regulators and investors. This puts a premium on data quality and governance. Insurers need to reconcile data across actuarial models, general ledgers, and reporting systems with absolute accuracy. As data platform company Atlan notes, IFRS 17 compliance “requires insurers to analyze data from actuarial systems, trading systems, claims, and accounting – and ensuring high-quality data across all these is essential”. Inaccurate or inconsistent data (e.g. misclassified contracts, missing fields) can distort profit calculations, leading to regulatory scrutiny or restatements. Yet initial implementations saw significant manual workarounds and data cleansing efforts due to tight timelines. The challenge for IT leaders is to deliver clean, validated data by design, not by heroic manual fixes after the fact.

- Slow, Manual Reporting Cycles: Legacy processes have made IFRS 17 reporting painfully slow at many insurers. Prior to automation, it was common for monthly closes to take 3+ weeks and quarterly reporting over a month. Such timelines are untenable under IFRS 17’s demand for timely disclosure. Spreadsheet-based workflows and manual reconciliations not only delay reporting but also introduce errors. Deloitte warns that IFRS 17’s added complexity and granularity put additional pressure on “fast close” processes, requiring new levels of efficiency. In short, insurers must modernize their data pipelines or risk missed deadlines and control issues.

Building a Scalable IFRS 17 Data Solution

To address these challenges, leading insurers are adopting modern, scalable data solutions centered on metadata-driven ETL, automation, and governance. Below are key technical components that IT executives should consider in an IFRS 17 data architecture:

- Metadata-Driven ETL Integration: A metadata-driven ETL framework allows teams to define data mappings and transformations once and apply them uniformly across datasets and systems. In practice, this means building reusable pipelines that can ingest any source format – whether delimited text files, Excel sheets, or database tables – and transform them into a standardized data model. One insurer’s IFRS 17 program leveraged a metadata-driven integration layer to unify data from nine disparate systems into a common format. By centralizing rules for field mappings, calculations, and business logic in metadata, they ensured compatibility across legacy Life, P&C, and actuarial systems without rewriting code for each source. The result is faster onboarding of new data feeds and easier maintenance when source systems change.

Leverage data catalog and mapping tools to manage this metadata centrally, so business and IT teams share a consistent view of data definitions.

- Automated Data Validation & Anomaly Detection: Robust automated validation is indispensable for achieving the near-100% data accuracy IFRS 17 demands. Successful implementations embed validation rules and anomaly detection at every stage of the ETL pipeline. For example, when consolidating policy data, the system should automatically check that totals and subtotals from source systems reconcile with the IFRS 17 calculation engine outputs (e.g. total premiums, cash flows). If any variance or missing data is detected, the pipeline flags it for review or rejects the load, preventing corrupt data from propagating. Advanced anomaly detection (using statistical checks or AI) can catch outliers – say, a negative claim amount or an unusually large reserve for a single policy – and alert data stewards to investigate. In one case, an insurer implemented 700+ automated data quality checks (from simple format validations to complex reconciliations), which boosted data accuracy to 99.7% by eliminating manual errors. Automated validation not only ensures accuracy but also speeds up reporting by avoiding rework; as Deloitte notes, it “improves controls and governance to mitigate risks, ensure compliance, and promote better oversight”.

- Scalable Processing & Performance Optimization: The sheer volume of IFRS 17 data requires a scalable architecture to process calculations and reporting in a reasonable time frame. Insurers are turning to cloud-based data lakes and distributed computing to handle spikes in data and computation. Techniques like partitioning data (e.g. by line of business or year), in-memory processing, and parallel computation (Spark or similar engines) can dramatically shorten processing windows. In our experience, performance tuning and parallelism cut batch processing times by 65% or more, enabling monthly reports in days instead of weeks . A key win for one insurer was reducing the monthly close from 20 days to just 5 days – a 75% faster turnaround – by moving from sequential, manual workflows to optimized, automated data pipelines. For IT leaders, investing in scalable cloud infrastructure and performance engineering yields not only faster compliance reporting, but also frees up teams to perform analysis on results sooner. The ability to close the books quickly can become a competitive advantage for the business.

- Unified Data Governance and Lineage: Given the cross-department nature of IFRS 17 data (spanning actuarial, finance, risk, and IT), strong data governance is non-negotiable. This includes establishing a clear data ownership model, data lineage tracking, and control policies from source to report. A best practice is to form a cross-functional data governance committee (including finance and actuarial data owners) to define a common business glossary for key terms (e.g. coverage unit, contractual service margin) and to oversee data quality issues. Data lineage tools or catalogs can document how data flows from source systems through transformations to the IFRS 17 disclosures, which is invaluable for audits and troubleshooting. Moreover, governance policies should codify validation and sign-off processes – for instance, which team approves a data load or adjustment at each stage. An integrated data governance framework ensures that as data moves through the ETL process, it remains traceable, controlled, and aligned with IFRS 17 definitions. Insurance CIOs have found that treating IFRS 17 data as a shared asset (rather than a departmental burden) not only ensures compliance but also builds a foundation for better analytics and business insights beyond compliance.

- Flexibility for Evolving Requirements: Lastly, IT leaders should design IFRS 17 data solutions with change in mind. The standard itself has evolved (with amendments in 2020), and local regulatory interpretations can add twists. A metadata-driven approach helps here, but it’s also important to maintain modular workflows. For example, if a new reporting field is required, the architecture should allow inserting that into the data model without a wholesale redesign. Similarly, parameterizing business rules (e.g. discount rates, groupings) makes the system adaptable. As one CFO observed during implementation, “the standard was a moving target… we had to remain agile and collaborate closely with software vendors to adapt to changes”. By emphasizing adaptability, insurers can avoid costly rework and ensure their IFRS 17 solution stays compliant and useful over the long term.

Case Study: Turning IFRS 17 Compliance into Competitive Advantage

To illustrate these principles in action, consider the IFRS 17 transformation journey of a leading insurance provider in Southeast Asia (an anonymized case based on a real implementation). This insurer faced typical challenges: nine different source systems (including a decades-old policy admin mainframe and separate actuarial modeling software), inconsistent data definitions, and labor-intensive reporting that took nearly a month each cycle. The goal was to achieve timely, accurate IFRS 17 reports without ballooning operational costs.

Solution Approach: The insurer implemented a comprehensive ETL and data governance solution to modernize its data architecture for IFRS 17. Key elements of the solution included:

- Reusable ETL Framework: A scalable, metadata-driven data integration framework was built to standardize and merge data from all nine sources. This framework was format-agnostic – ingesting CSV, Excel, and database extracts – and applied uniform transformation logic to map legacy data into the new IFRS 17 data model. By designing independent yet interoperable workflows for each source, the team could onboard systems one by one without disrupting others. Crucially, secure automation (e.g. scheduled sFTP transfers) replaced manual data file handling, establishing a reliable nightly data refresh across systems.

- Built-in Data Quality Controls: The solution baked in automated validation and anomaly detection at every step. Data records had to pass hundreds of validation checks (completeness, format, business rule consistency) before being accepted into the IFRS 17 reporting layer. Any anomalies (like out-of-range values or mismatches between actuarial outputs and finance ledgers) triggered alerts for investigation. This drastically reduced manual reconciliation. The insurer also implemented an “error dashboard” that highlighted data issues in real time, enabling quick fixes by the responsible teams. Over 120 ETL flows were deployed with consistent controls, ensuring error-free integration across the enterprise.

- Cross-Team Collaboration and Alignment: Recognizing that technology alone wasn’t enough, the IT leadership fostered close collaboration between Finance, Actuarial, and external advisors. They set up joint workshops with their consulting partners (including PwC and Grant Thornton) to ensure the data transformation rules accurately reflected IFRS 17 calculation logic and disclosure requirements. This streamlined collaboration meant that as the IFRS 17 interpretations evolved, the data team quickly adapted the ETL mappings and calculation engines in tandem. Regular alignment meetings between actuarial and IT teams helped embed business context into technical design – for example, agreeing on how to implement the contractual service margin roll forward in the data pipeline.

- Performance Optimization: The IT team anticipated the performance challenge and optimized the solution for speed. They partitioned processing by product line to run in parallel and implemented incremental loading to avoid re-processing unchanged data. Leveraging cloud infrastructure, they scaled compute resources during quarter-end crunch time. These optimizations, combined with the removal of manual bottlenecks, slashed the reporting timeline dramatically. Monthly financial statement production, which previously took 20 days, was completed in just 5 days, and the quarterly reporting went from 25 days to about a week. This 75% faster reporting freed up nearly 15 business days for the finance team to analyze results and address insights before finalizing reports – a game changer for the CFO’s office.

Outcomes: By the end of the transformation, the insurer achieved outcomes that not only ensured compliance but also delivered tangible business value:

- 99.7% Data Accuracy – Data errors became virtually extinct. Automated validations and reconciliation routines delivered 99.7% accuracy in financial data, eliminating costly restatements or audit issues. Clean data gave executives confidence in the numbers and allowed analysts to focus on value-added analysis instead of data cleanup.

- 75% Faster Reporting Cycles – Automated, efficient data pipelines compressed the monthly close from 20 days to 5 days, and the quarterly from 25 to 7 days. This fast-close capability means leadership gets timely insights and can respond quicker to business changes. It also reduces stress on teams, who no longer have to work nights and weekends on protracted closing tasks.

- 45% Reduction in Manual Effort – By replacing spreadsheet jockeying with workflow automation, the insurer cut nearly half of the manual work out of its financial reporting process. Teams estimated that hundreds of hours per month were saved on data preparation and reconciliation. This not only improves efficiency but also boosts morale – skilled staff can now focus on analysis and strategic projects instead of tedious data compilation.

- 30% Lower IT Costs – Retiring or reducing reliance on legacy systems yielded significant savings. The modern ETL platform enabled a phased decommissioning of several old data marts and EUCs (end-user computing apps), lowering maintenance costs by about 30%. Moreover, the cloud-based solution scaled with demand, so the company avoided major capital expenditures on new hardware. In essence, smarter architecture paid for itself through operational cost reduction.

- Scalability and Future-Readiness – With over 120 automated data flows in production, the insurer built a highly scalable integration layer capable of absorbing new portfolios and acquisitions with minimal effort. The data governance practices put in place for IFRS 17 are now being extended to other regulatory and analytical initiatives. In fact, the organization is repurposing the “IFRS 17 data hub” as a general insurance data lake to drive advanced analytics, risk modeling, and AI use cases – turning a compliance project into a strategic data asset.

For insurance IT leaders, this case exemplifies how tackling IFRS 17 data challenges head-on can yield benefits well beyond mere compliance. By investing in robust data infrastructure and governance, the company not only met the IFRS 17 requirements but also accelerated its overall digital transformation.

Delivering Value to the Insurance Enterprise

The technical deep dive above underscores a key message: IFRS 17 compliance, done right, can be a catalyst for modernization. CIOs and data executives who implement smart, automated IFRS 17 data solutions are essentially building the foundation for cleaner, faster, and more cost-effective data operations enterprise-wide. This directly supports top business goals of insurance carriers:

- Reduced Operational Drag: By eliminating manual processing and spreadsheet dependence, IT leaders enable finance and actuarial teams to reclaim their time. Instead of scrambling to compile data, they can deliver actionable insights to leadership. This shift from manual grunt work to strategic analysis is invaluable for a forward-looking insurer.

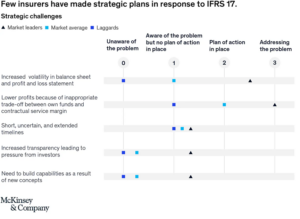

- Timely, Trusted Insights: A single source of truth for IFRS 17 data, backed by strong controls, means that management and regulators can trust the reported numbers. Executives get rapid access to performance indicators (e.g. actual vs expected profits by product line under IFRS 17) in days, not weeks. In an industry where agility is increasingly a competitive differentiator, faster insight translates to better decision-making. According to McKinsey, IFRS 17’s increased transparency and data granularity can invite tough questions from investors, but those insurers who have invested in robust reporting are turning this into an opportunity to build investor confidence and credibility.

- Cost Efficiency and Scalability: The convergence of data from legacy systems onto modern platforms creates opportunities to streamline IT costs. Insurers can decommission redundant systems (as seen with a 30% cost cut in the case above) and reduce technical debt. More importantly, a scalable data architecture ensures that as business volumes grow or new regulatory requirements arise, the existing framework can handle it with minimal marginal cost. This scalability is crucial for meeting future demands – whether it’s a new IFRS update, evolving local regulations, or integrating an acquired portfolio’s data.

- Compliance and Risk Management: With automated controls and end-to-end data lineage, the risk of non-compliance is drastically lowered. Audit trails are built into the system. Teams can quickly answer “where did this number come from?” – a question that auditors and regulators will certainly ask. KPMG emphasizes that after the rush to meet deadlines, insurers are now focusing on “creating value beyond compliance” by enhancing automation and adaptability in their IFRS 17 solutions. In practice, this means the systems are not just compliant on paper, but resilient and sustainable for the long run, reducing the likelihood of errors, missed deadlines, or regulatory penalties.

Conclusion

IFRS 17 has undoubtedly been a challenging test for insurance IT organizations, but it also presents a once-in-a-generation opportunity to elevate data practices. The insurance CIOs and CTOs who approach IFRS 17 with a strategic mindset – investing in metadata-driven ETL frameworks, automated quality controls, and strong data governance – are reaping rewards in the form of faster close cycles, higher data confidence, and lower costs. As one Deloitte report noted, IFRS 17 implementation requires tight integration between finance, actuarial, and IT, and those who succeed lay the groundwork for a more agile future.

In the end, meeting IFRS 17 requirements is about more than checking a compliance box – it’s about building a data-driven insurance enterprise. The CFO of tomorrow’s insurance carrier will expect near-real-time, accurate insights at their fingertips, and thanks to the systems put in place today, that vision is within reach. By solving IFRS 17’s data challenges now, insurance IT leaders are not only ensuring compliance at scale and securely, but also empowering their organizations with clean, trusted data that fuels better decisions. In the volatile landscape of insurance, that is a true competitive advantage.

Sources

- McKinsey – “IFRS 17: Insurers should plan for strategic challenges now.” (2019)

- Atlan – “Data Quality in Insurance: Business Benefits & Core Capabilities.” (2023)

- Deloitte – “IFRS 17 is a Challenging Test – How to convert IFRS 17 challenges into opportunities.” (2022)

- org – “IFRS 17 Implementation – Canadian Insurers’ Experience.” (2024)

- Addactis – “IFRS 17 & Data: Key Challenges and Solutions for Actuaries and Financial Teams.” (2024)

- KPMG – “IFRS 17: Current challenges and creating value beyond compliance.” (2023)

- com – “Enhancing Financial Transparency for a Leading Insurance Provider: IFRS 17 Implementation”(2025)

Tuesday, 13 May 9:00 am

Tuesday, 13 May 9:00 am Friday, 25 Apr 6:30 pm

Friday, 25 Apr 6:30 pm Wednesday, 31 Jul 9:30 am

Wednesday, 31 Jul 9:30 am